Yes, we offer joint car refinance services. If your circumstances have changed since you first took our HP or PCP finance with either ourselves or another company, the refinancing your current loan could be a great solution for you, but every situation is different so there's no guarantee that refinancing will be beneficial in every case. The only concrete way to know if refinancing is something you could benefit from is to get in touch with one of our finance specialists.

One benefit of refinancing could be that you find a vehicle loan with lower monthly repayments. If you need help to make your repayments or need more disposable income, there's no need to wait until the end of your agreement. You could swap to a loan with cheaper monthly repayments and a more extended repayment period instead.

Are you looking for a better deal? Credit scores aren't fixed and yours might have improved since you took out your finance. In fact, if you've kept up with your repayments, your existing loan could have boosted your rating! Refinancing could mean you find a loan with a lower rate of interest, lowering your monthly repayments, or reducing the total amount payable.

It's also an option for people coming to the end of a PCP agreement. To keep the vehicle, you'll need to pay the balloon payment. Taking out a loan to split this one-off cost into manageable monthly repayments could mean you can keep a campervan you'd otherwise have to hand back to the lender.

We can refinance Hire Purchase (HP) or Personal Contract Purchase (PCP) deals.

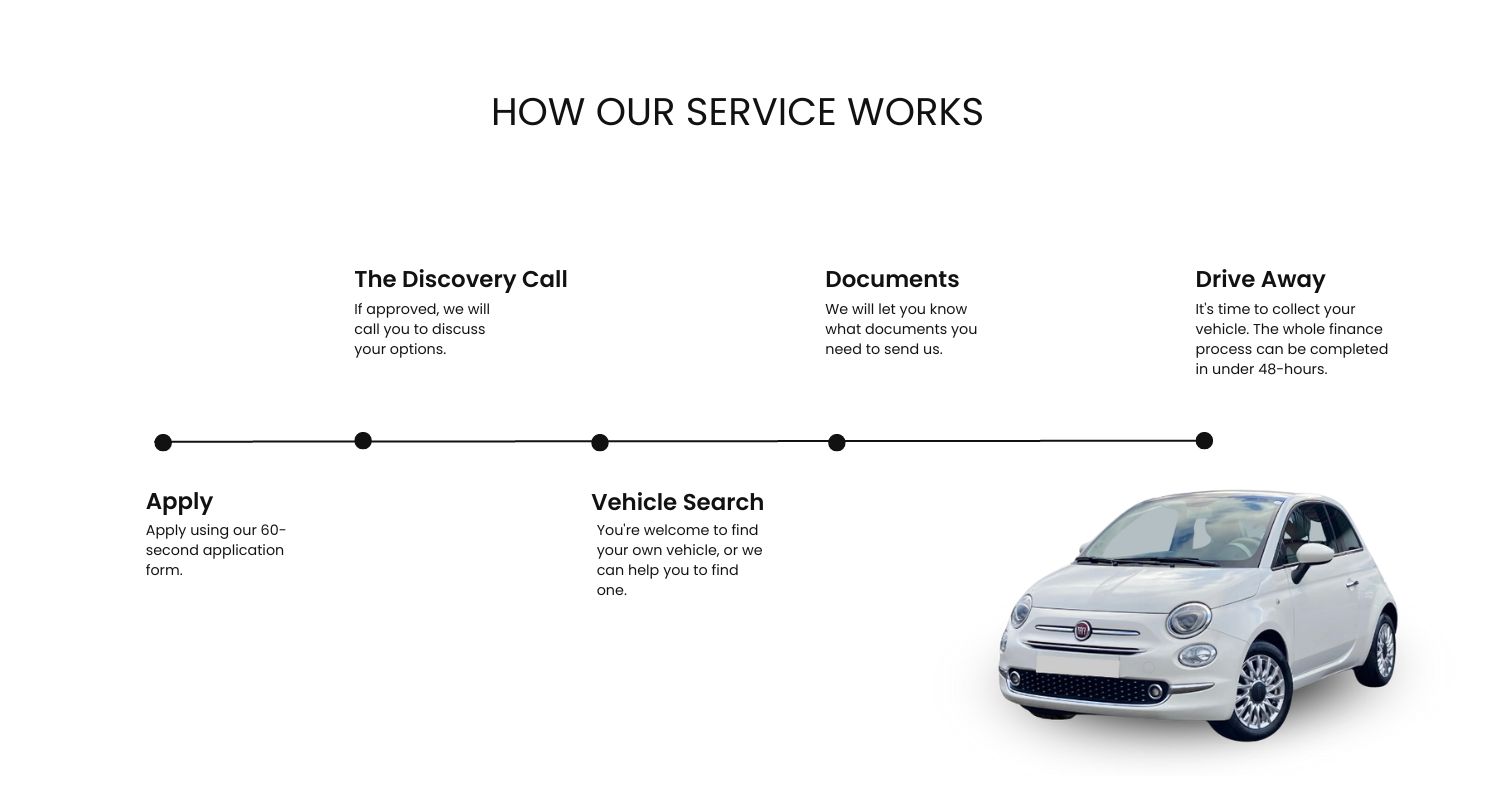

To apply for finance, no documents are required initially. It is only after being accepted for finance that you will need to provide proof of income, identification and proof of address. However, each lender requires different types of documents so you will need to wait to find out exactly which type of document you need to provide.