It is possible to get car finance with bad credit, but the terms may not be as favourable compared to individuals with good credit. For instance, you might have to pay a higher APR because of the perceived risk that a lender places upon an individual with a poor credit score. However, understanding the basics of your credit score and the steps required to improve and maintain it will help you to not only improve your chances of securing car finance with bad credit but also improve those less favourable terms.

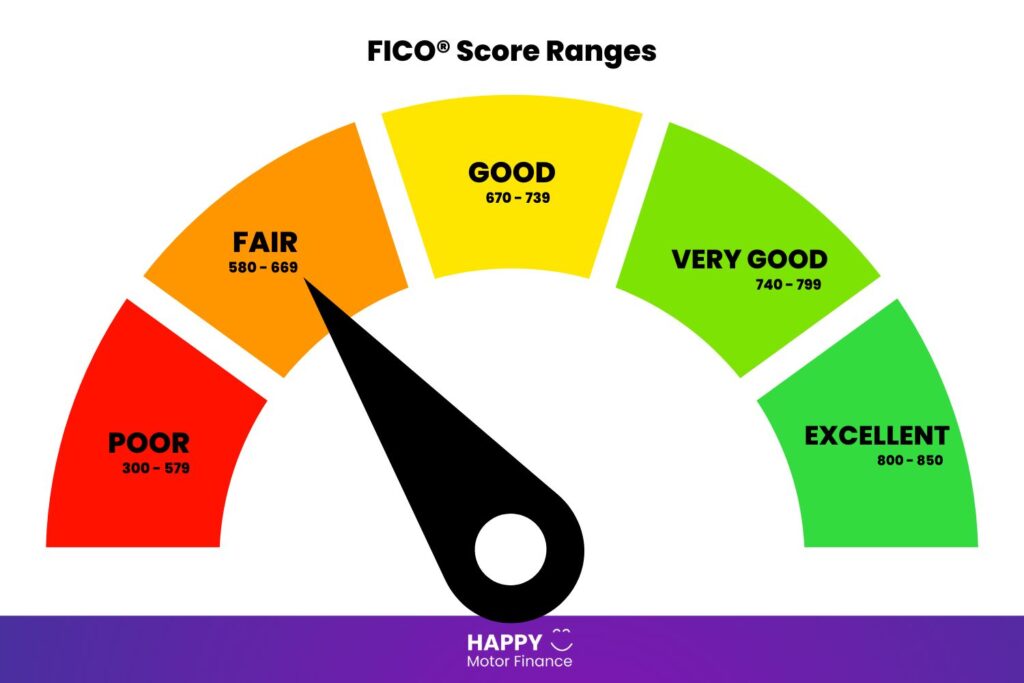

Credit scores are measured by the Fico Score Ranges which you can see in the above graphic. And the difference between an excellent, good and poor credit score depends on how many points an individual has -the more the better, with the top end of the range hitting 850.

There are other types of credit score available, that operate in the same manner, but if you would like to check your Fico credit score, then you can view this by opening an account on Experian.

Many traditional lenders, such as banks and credit unions, may be less likely to approve a car loan for someone with bad credit. However, there are specialised brokers who work with individuals with bad credit and can offer car finance like ourselves.

The interest rates and fees on car loans for individuals with bad credit may be higher than those for individuals with good credit, and the down payment required may also be higher. It may also be helpful to work on improving your credit before applying for a car loan. This can include paying off any outstanding debts, making all of your payments on time, and keeping your credit card balances low.

Other tactics you can do to improve your credit score are:

-Up to 30% of your credit score is made up of amounts owed. If you can, pay your credit card bill in full every month to clear the balance.

–

In summary, it’s possible to get car finance with bad credit, but it may come with more challenges and higher costs. It may be easier to use a specialist broker who can perform soft search checks like ourselves to obtain the best possible rate whilst not impacting your credit score.